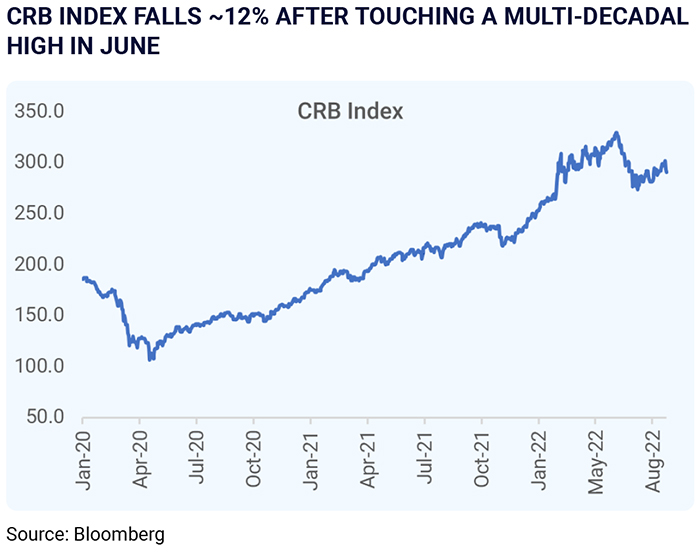

Over the last two years, there have been big movements in the prices of several commodities. The Brent oil price increased from a low of $20 a barrel in April 2020, during the first Covid-19 wave to a peak of $122, in March 2022, after Russia invaded Ukraine. The sharp rally in the prices was not limited to only oil. Even prices of copper, wheat, and other commodities also witnessed sharp movement over this period. Global indices of commodity prices (as represented by the CRB index) almost tripled from April 2020 to March 2022.

However, recently the prices of some of these commodities have started

to fall sharply. The oil prices decreased by about 30% between June and

August. The overall CRB index has fallen 12% from its peak.

One of the obvious reasons for such a decline in the prices of

commodities is slowing global growth. China's growth rate has faltered

dramatically (particularly in the commodity-intensive manufacturing

sector). It turned negative in the second quarter, as Shanghai and some

other cities endured shutdowns in support of a futile zero-Covid policy.

Even though the Chinese government has been announcing several small

measures to revitalize the economy, no big bang stimulus has been

announced. Europe is hard-hit by the side effects of the Russian invasion

of Ukraine. Even US growth is slower in 2022 than last year, with many

proclaiming that a recession has begun.

According to the IMF's most recent World Economic Outlook update, global

growth is projected to slow substantially, from 6.1 % in 2021 to 3.2 % in 2022

and 2.9 % in 2023. Slowing growth means lower demand for commodities

and hence lower prices.

Slow global growth has direct implications on

commodity