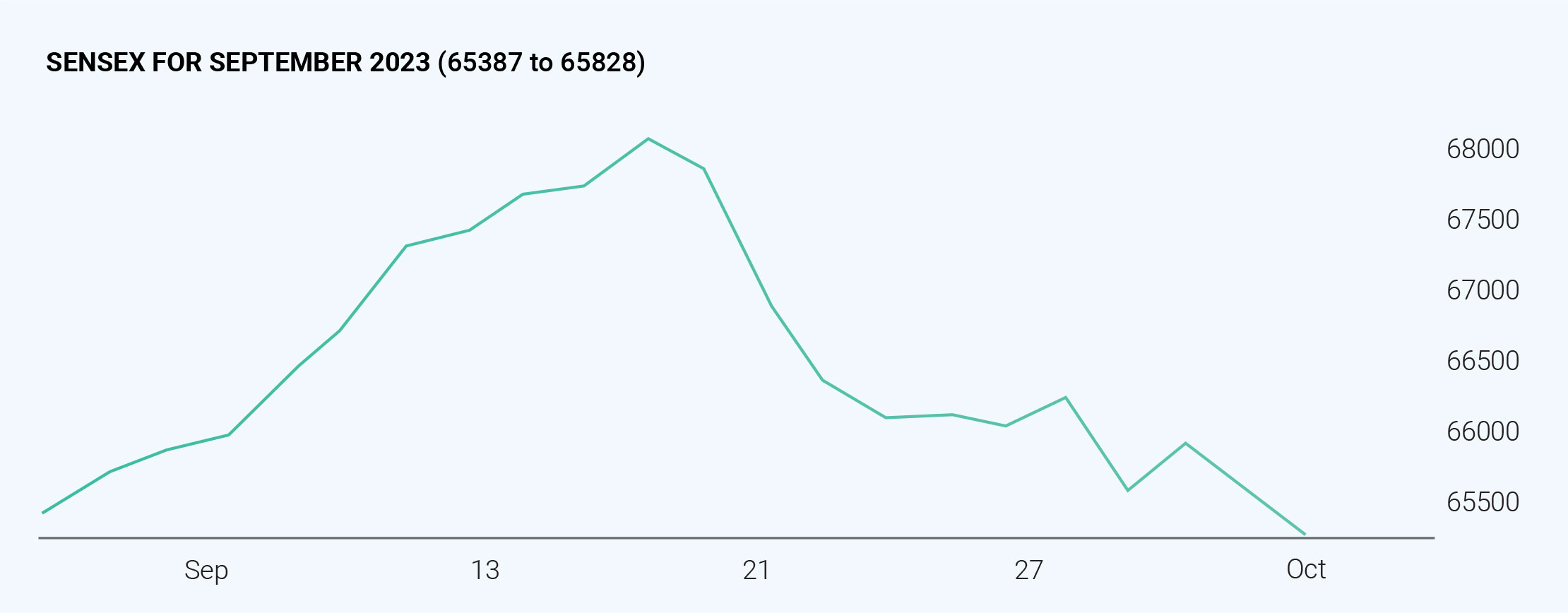

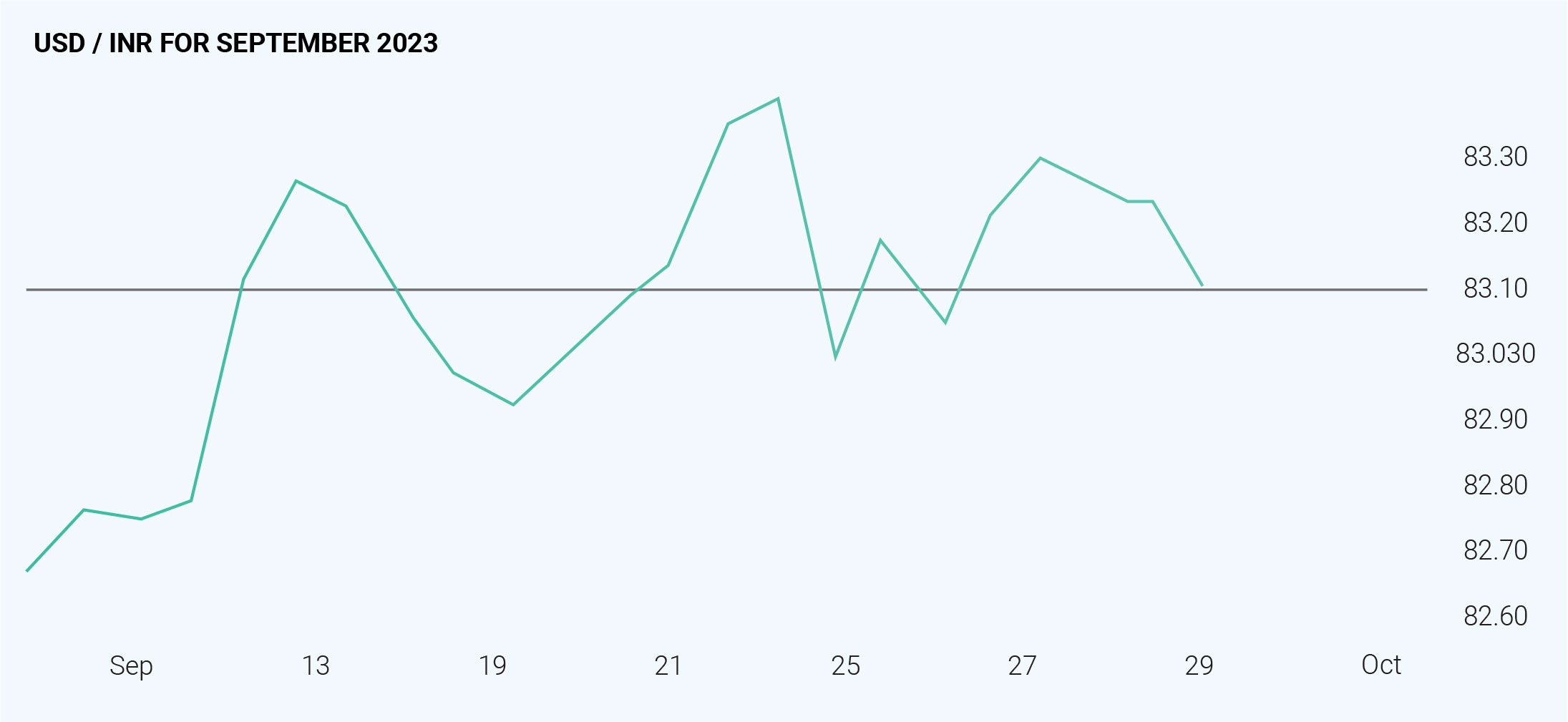

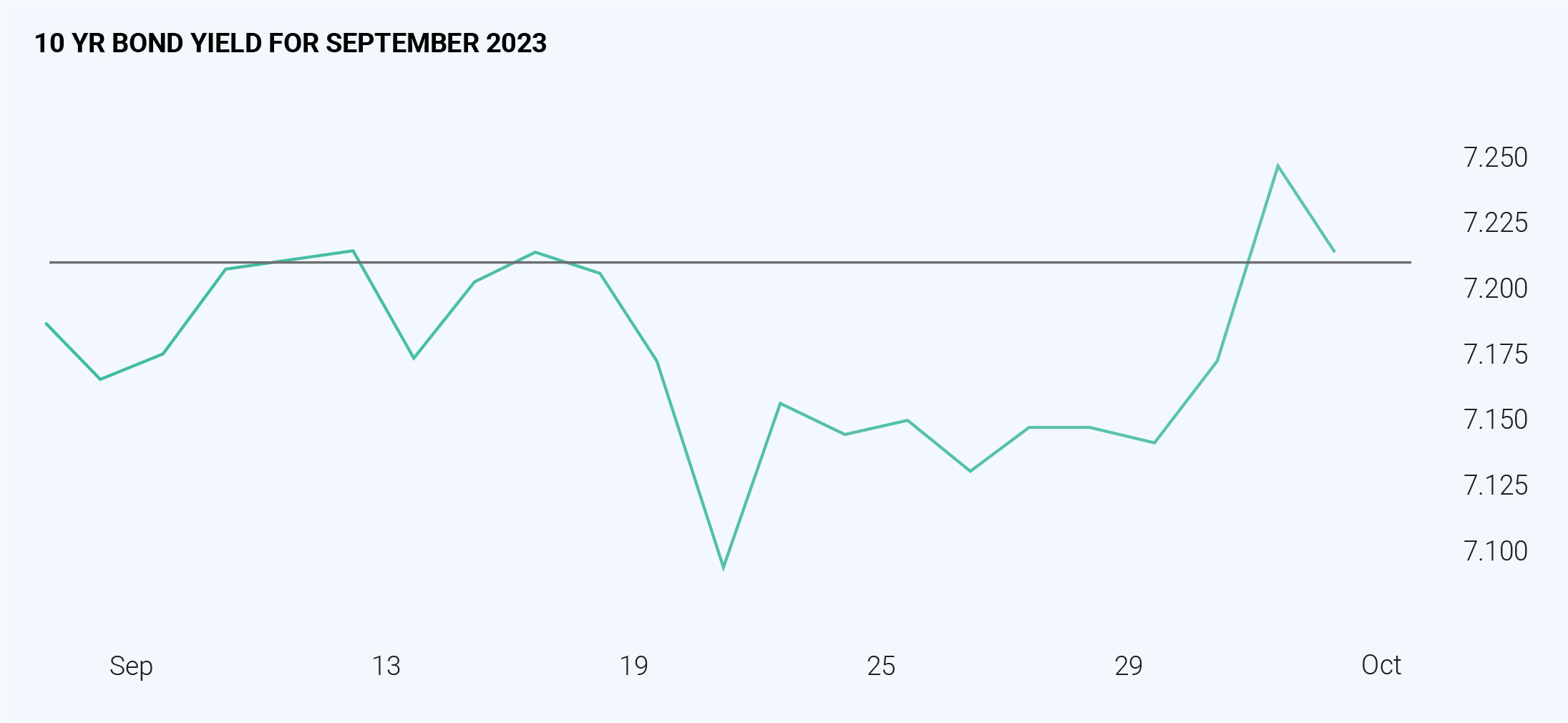

The markets were highly volatile in the month of September 2023 due to global and domestic factors. In the mid-month the markets were all time high touching 67788, from there it declined touching 65721 on 29th September. Sensex and Nifty gained 2% and 1.5% over the month respectively. Since April market has been moving in positive mode touching highs with continuous inflows from Foreign investors, but they pulled out flows and for the last two months domestic investors have been supporting the markets. Markets are in a very fragile phase because of the strong US dollar Index, higher US Bond yields, rising crude prices, foreign investors' outflows and India’s increasing trade deficit too. Despite of Indian economy holding on to stability by various prompt measures taken by the government, still the global economic recession is pulling down the markets. FIIs and HNIs selling considerably due to global equity performance. The global markets are under pressure from high inflation and sustained high interest rates. Elevated bond yields in the wake of corporate and household spending are challenging the equity markets. The level of selling by FIIs has been relatively moderate. This can be attributed to the belief that the domestic economy is poised to decouple from the global economic trends, driven by industrialization and favourable business policies. It is important to note that the impact of FIIs' selling activity is cushioned by the positive inflows from DIIs and retail investors. Net selling by FIIs is ₹16,026cr on 27th Sept while net inflow from DIIs is ₹14,230cr as on 21st Sept. The silver lining for India here is its stable economic condition and prompt policy decisions. Although the macroeconomic conditions are unstable, still the Indian economic conditions are being managed proactively by taking several measures to control food inflation like cutting down on exports of wheat, and rice and levying duty on onion exports. RBI’s inflation rate is under its target band until now and hope the central bank will curb the inflationary pressure successfully. The upcoming monetary policy will be announced on 6th October 2023 after three days of MPC meeting considering all the economic numbers. Market analysts are positive about RBI’s stance to maintain a bit of hawkishness on inflation dynamics, given various uncertainties such as climate conditions, commodity prices, and global risk positioning. RBI would opt for a CRR (cash reserve ratio) rate hike to tighten liquidity and improve transmission this time around. A report by CRISIL -'RateView - CRISIL's outlook on near-term rates' also said that the central bank will hold the repo rate in October. The report also said that a 25 basis point hike is a conditional possibility for now. Short-term G sec moved into a positive phase due to rising US yields whereas long-term remained stable. Weighted average yields for 1-year and 3-year residual maturity g-secs increased by 6 and 4 basis points, reaching 7.14 percent and 7.18 percent respectively. In contrast, 5-year g-secs maintained stability at 7.16 OCTOBER percent, and 10-year g-secs saw a one basis point decline to 7.17 percent. The possibility of short-term yields is increasing because of uncertainty expectations due to global and domestic uncertainties. The Federal Reserve’s hawkish stance, with rates maintained at a 22-year high, directly impacts both short-term and long-term yields. This decision sets the tone for the entire yield curve and plays a crucial role in shaping the financial landscape. Foreign investors’ investments in the Indian market are closely related to the yield environment. As their exit from equities and reallocation of funds impact short-term and long-term yields. The crude oil prices in India continued their upward trajectory, averaging USD 94.7 per barrel. On September 19, oil prices even briefly touched USD 95.6 per barrel. This increase was driven by production cuts and export bans imposed by various OPEC+ nations because of slowdown of Chinese economy, which exerted upward pressure on oil prices there would not be any relief from price pressure. The inflation would adversely get affected since the government’s borrowing costs will increase. During the last week of September 2023, the rupee witnessed a devaluation of 0.20% against the US Dollar, settling at Rs.83.14 per USD. On an extraordinary note, the INR touched an unprecedented low of Rs.83.26 per USD on September 20. The unwaveringly hawkish stance adopted by the US Federal Reserve strengthened the US Dollar Index, marking an approximate 0.20% increase in the two days after the meeting. In September the overall liquidity remained deficit, the factors that led to the deficit is RBI’s auctions of variable rate reverse repos acting to absorb the liquidity from the banking system. GST and advance tax influx also aggravated the deficit. And lastly due to RBI’s selling of dollars to counteract the rupee weakening. But on the positive front, this liquidity crunch is for the short term, as there is an increase in government spending and the redemption of government securities. With global and domestic pressures on both equity and debt markets on the back of sluggish economies, high inflation worries, and high-interest rate risks. Selling in emerging markets is expected for the short term, but for India, the positive inflows from domestic investors would be beneficial.