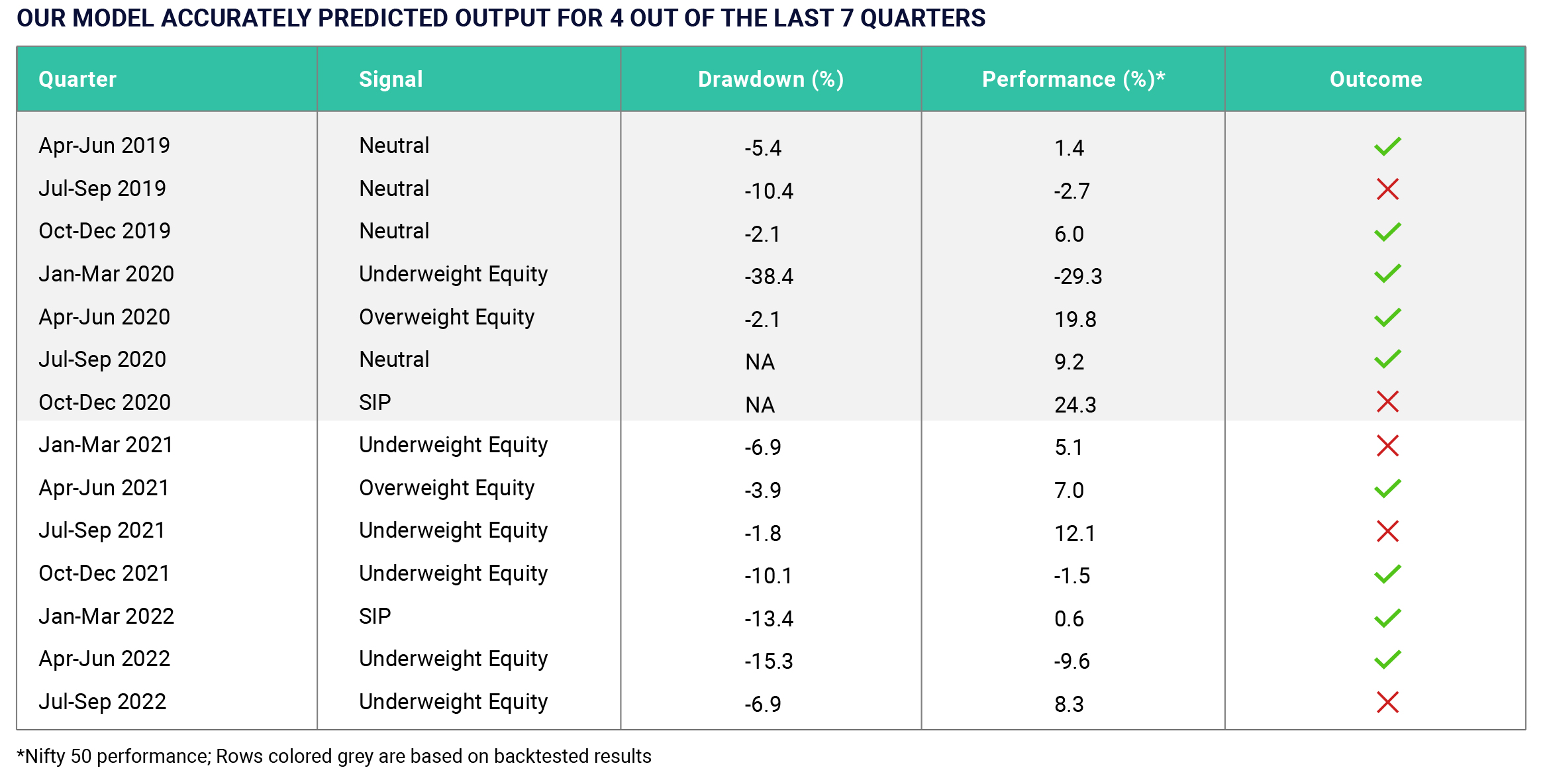

For the last quarter (Q2FY23), our Tactical Intervention Approach (TIA) model recommended going underweight on the markets. While the market ended the quarter recording positive gains, it witnessed heightened volatility on the back of several global and macro concerns. For Q3FY23: Our model suggests continuing the Underweight stance on the equity markets A quick recap on our model: We give distinct 15-18 input factors to our program, broadly classified into macro (market capitalization to GDP), valuation (P/ E, P/B, etc.), momentum indicators, trends, volatility, liquidity, and so on. Besides their absolute value, we take the first derivative (implying % change and direction of the change) for some parameters. The model identifies a pattern in the data set and produces market predictions without following instructions coded by humans. It helps us remove all biases and prenotions developed by humans on the markets.