Indian market was no exception and witnessed elevated volatility in Q2FY23 triggered by global and macro headwinds. Rupee depreciated 2.3% against

the US dollar in Sept 2022 even as Forex reserves decline $96 bn in CYTD. By the end of the quarter, the RBI hiked repo rate by 50 bps to 5.9% and revised

GDP growth forecast down to 7.0% from 7.2% earlier.

While the Indian economy faces several headwinds, the corporate India is confident about margin expansion in H2FY23 owing to recent weakness in

commodity prices. The lean balance sheets of both corporate India and Indian Banking sector are encouraging corporates to kick start their capital

expenditure plans after several years of indifference. The aggregate earning of Nifty 50 companies is expected to remain flat in Q2FY23 after eight

quarters of growth.

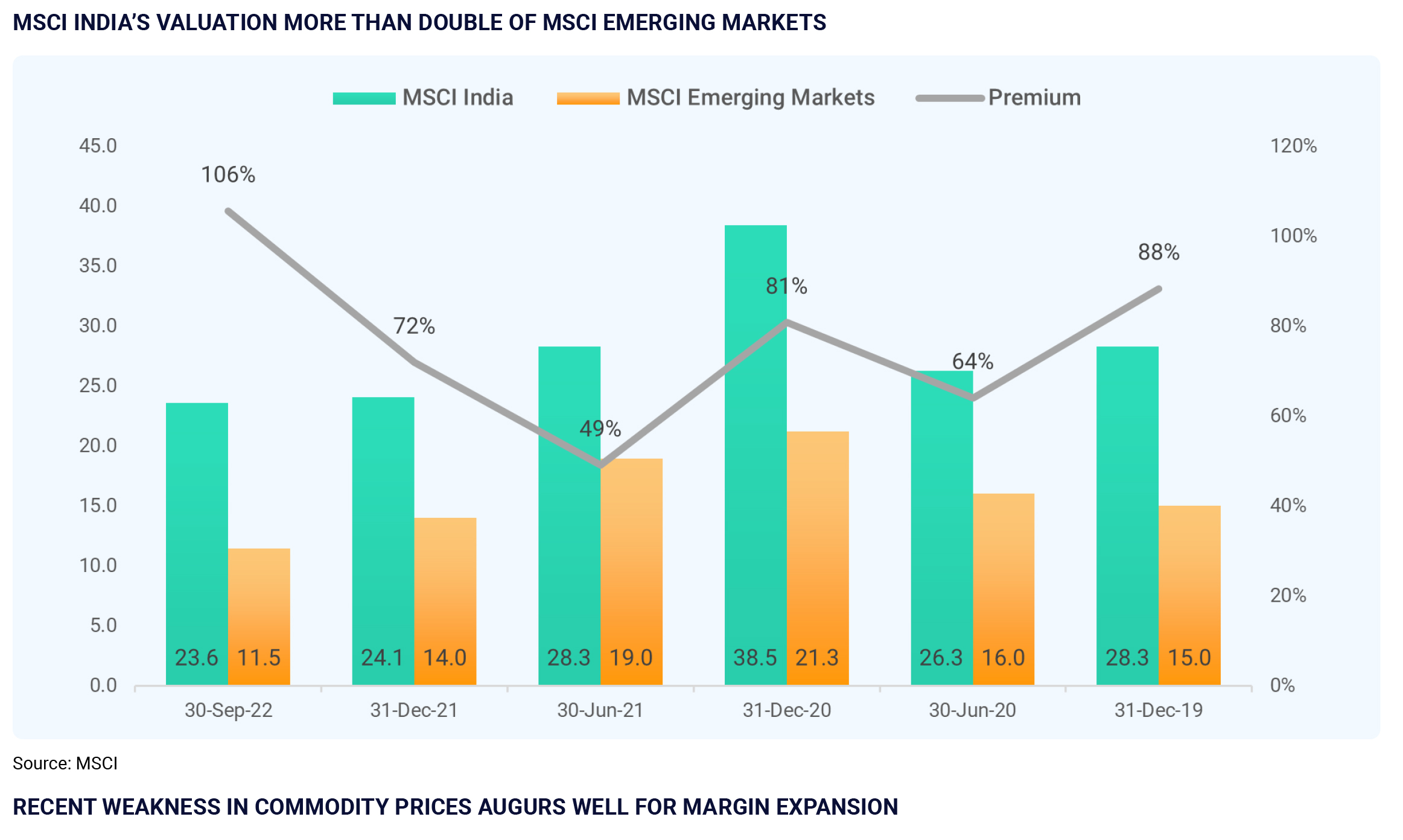

The Indian stock market has surprised everyone by its resilience in the face of bearish sentiments across the globe. The outperformance of Indian markets

vis-à-vis other emerging markets has led to expansion in the valuation. Valuations are at a multi-year high premium vs EM countries and thus could induce

volatility on the back of any major global developments.