PACE OF FED RATE HIKES HAS BEEN RAPID IN THIS CYCLE COMPARED TO PREVIOUS ONES

After witnessing significant earnings growth in the first half of 2022, all

eyes are now on the third quarter earnings season. Markets are heading

into the earnings season on poor footing as US stocks are witnessing

heightened volatility amid concerns that the Fed's aggressive rate hikes

will result in a possible recession. Analysts will track EPS and guidance in

each sector and will likely adjust the earnings and revenue estimates for

the next few quarters.

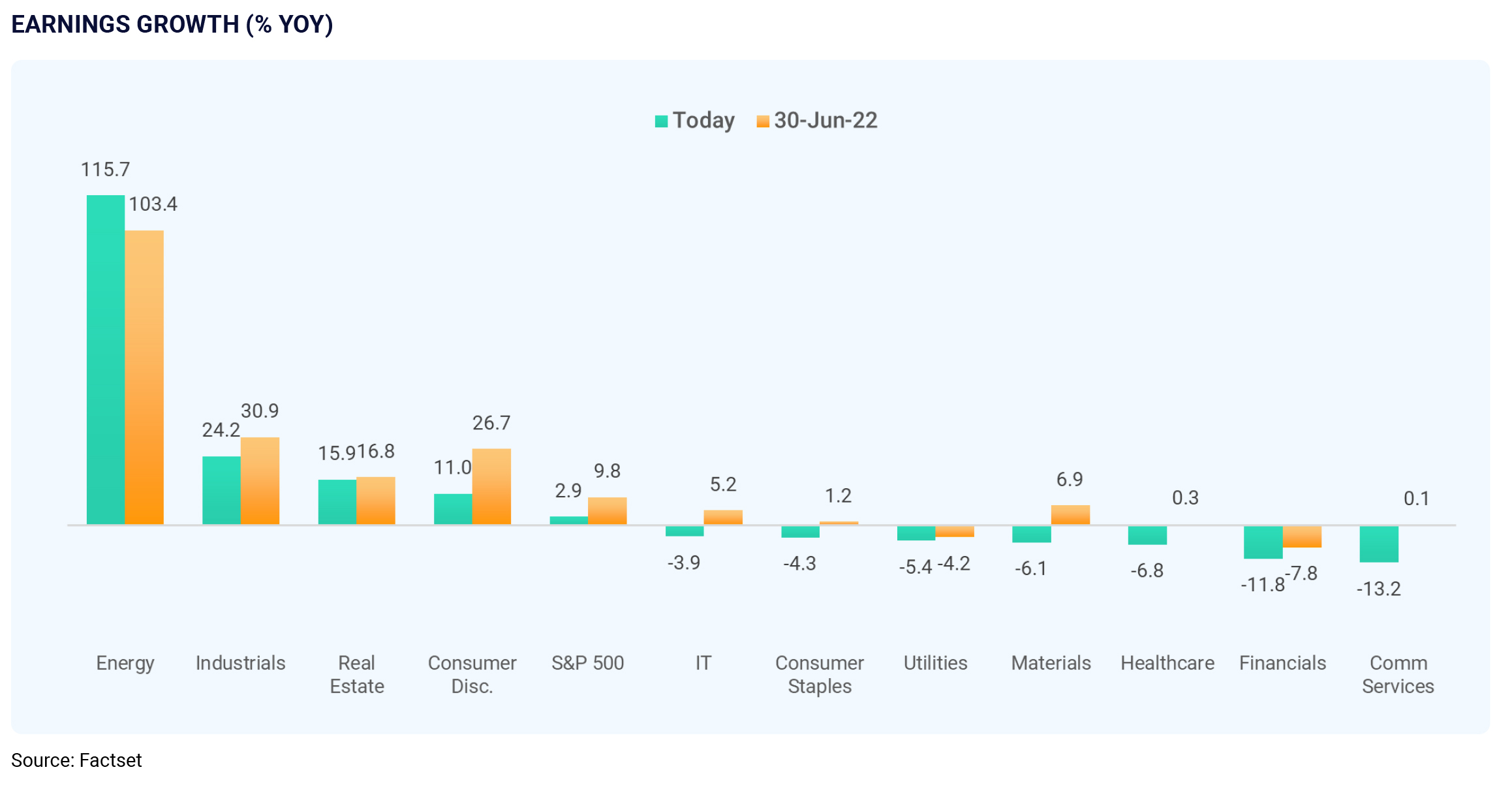

At the end of June, analysts expected third-quarter EPS for the S&P 500

index to be 9.8% higher than last year's third quarter. However, there have

been a series of earnings downgrades over the previous three months. For

Q3 2022, analysts expect EPS growth to be just 2.9%, as they believe it

would be difficult for businesses to maintain profitability given the current

economic environment. Labour costs, supply chain disruptions, and

unfavourable foreign exchange rates are some of the major concerns

negatively impacting earnings. From an earnings contribution perspective,

we expect companies within the energy and industrial sector to be the

major contributors toward overall growth in the earnings for the index.

Currently, markets are looking at companies to provide forward guidance

for the last quarter of 2022 and CY2023. Given the host of worries, we may

see an increase in companies either withdrawing forward guidance or

lowering forward guidance which will bring further downward revisions to

earnings and revenue estimates.