The Fed continues its promise to fight against inflation until it brings the

core inflation down to 2%. Based on the most recent estimates, the Fed

sees the federal funds rate moving to the 4.5-4.75% range by early 2023.

This may lead to some pain in the economy, perhaps recession. Also, this

involves some risk that the Fed's aggressive tightening may potentially

destabilize the financial system in the process.

Volatility has spiked across asset classes, raising concerns about the

ability of the global economy to cope with sharply higher interest rates. If

volatility in the financial market continues, the Fed may end up moderating

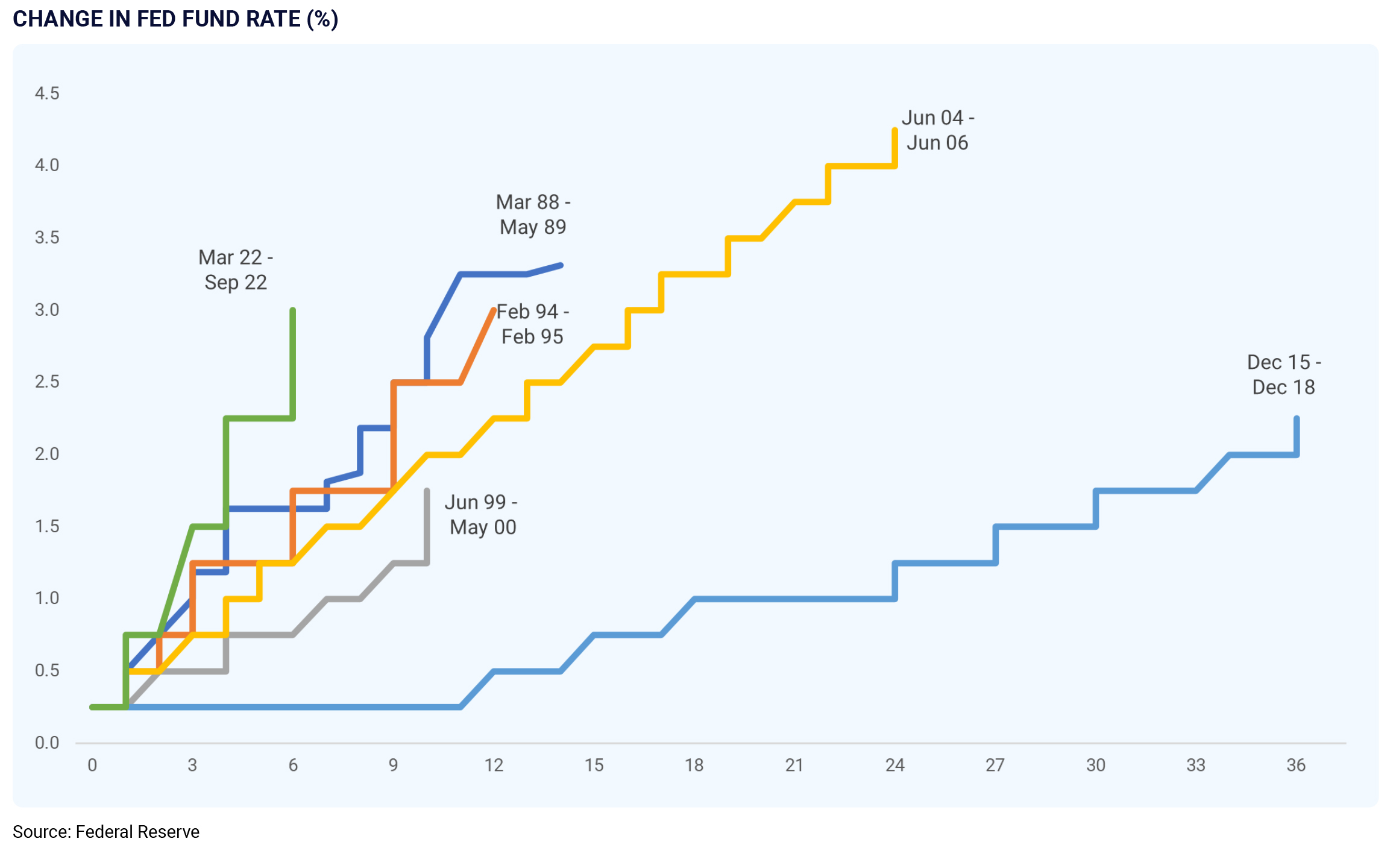

The Fed was late to tighten monetary policy, allowing inflation to rise, but

they have made up for lost time since its first-rate hike in March 2022. The

federal funds rate has increased by 300 bps at an accelerating pace, one

of the fastest rate-hiking cycles.

The impact of rate hikes has started working its way through the economy.

GDP growth has slowed, led by weakness in housing and manufacturing.

Moreover, commodity prices have fallen sharply from their peak levels.

The Fed's effort to slow down the demand side of the economy seems to

be working.

We believe market pressures may force the Fed to slow with future rate

hikes. Also, the Fed’s attempt to bring inflation back to 2% could increase

the stress in the global financial market.