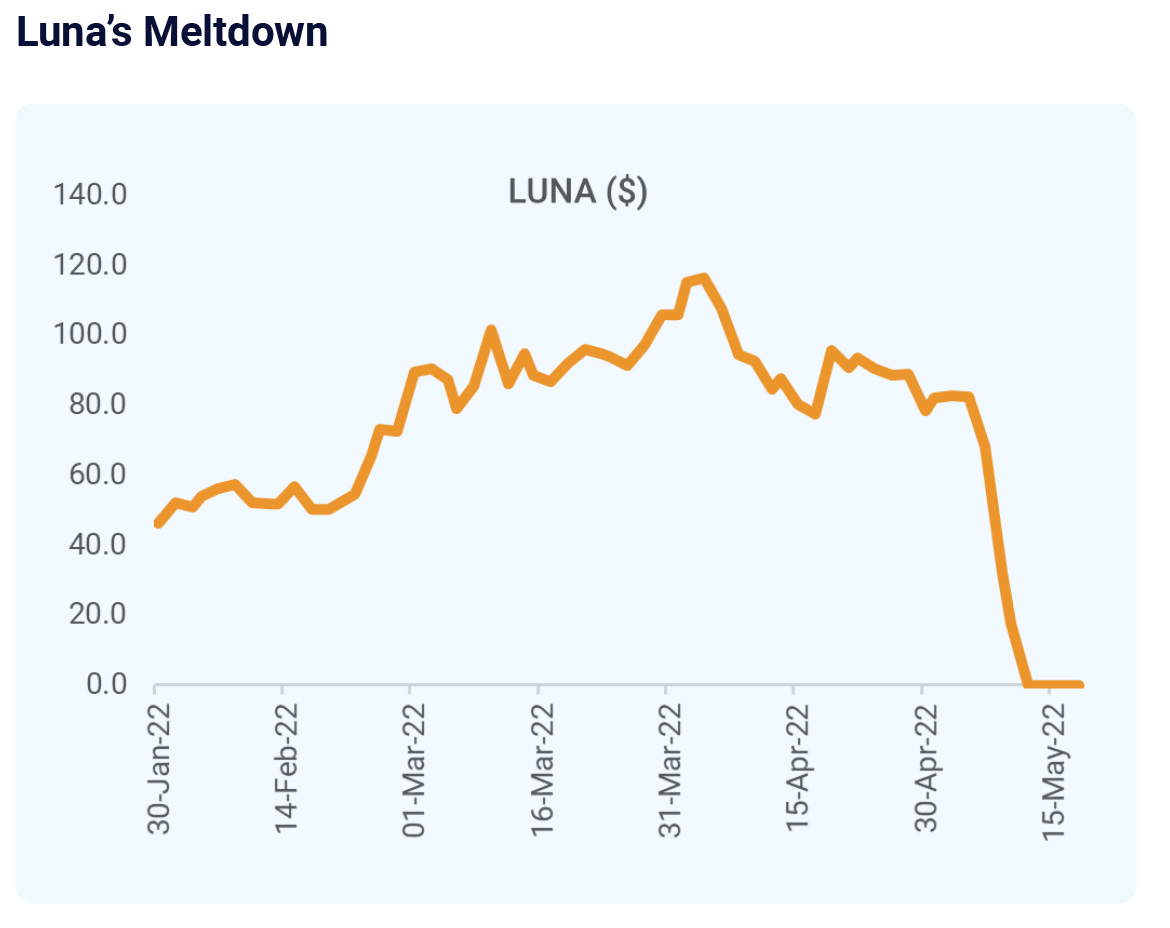

Hundreds of billions of dollars got wiped off as the prices of most cryptocurrencies plunged to their lowest point since 2020. Even an algorithmic stablecoin called TerraUSD (UST), a digital token designed to maintain a peg of 1:1 with the dollar, plunged, posing the biggest test to decentralized finance.

The collateral damage of UST losing its peg was extensive on the crypto

token, Luna (the cryptocurrency that helps UST stablecoin maintain its dollar

peg), which nosedived from trading at a high of around $119 in April 2022 to

a mere fraction of a cent (~$0.0002).

The crypto market may bounce back in the future, but the message is clear:

Cryptocurrency as an asset class is not ready to be part of an investor’s core

portfolio.

Bitcoin, the largest cryptocurrency, is sought as a substitute for fiat

currencies, is highly volatile and often expensive, with little recourse when the

coins get lost or stolen. Even mining these coins consumes energy

resources, producing a carbon footprint. While efforts are made to remedy

these flaws, there has been no major outbreak.

The crypto exchanges, payment apps, custodians, and miners take a cut

every time somebody makes a trade stand to gain maximum as the market

evolves. However, the risk goes far beyond their risk-taking ability for

unsophisticated investors with limited knowledge of crypto markets.