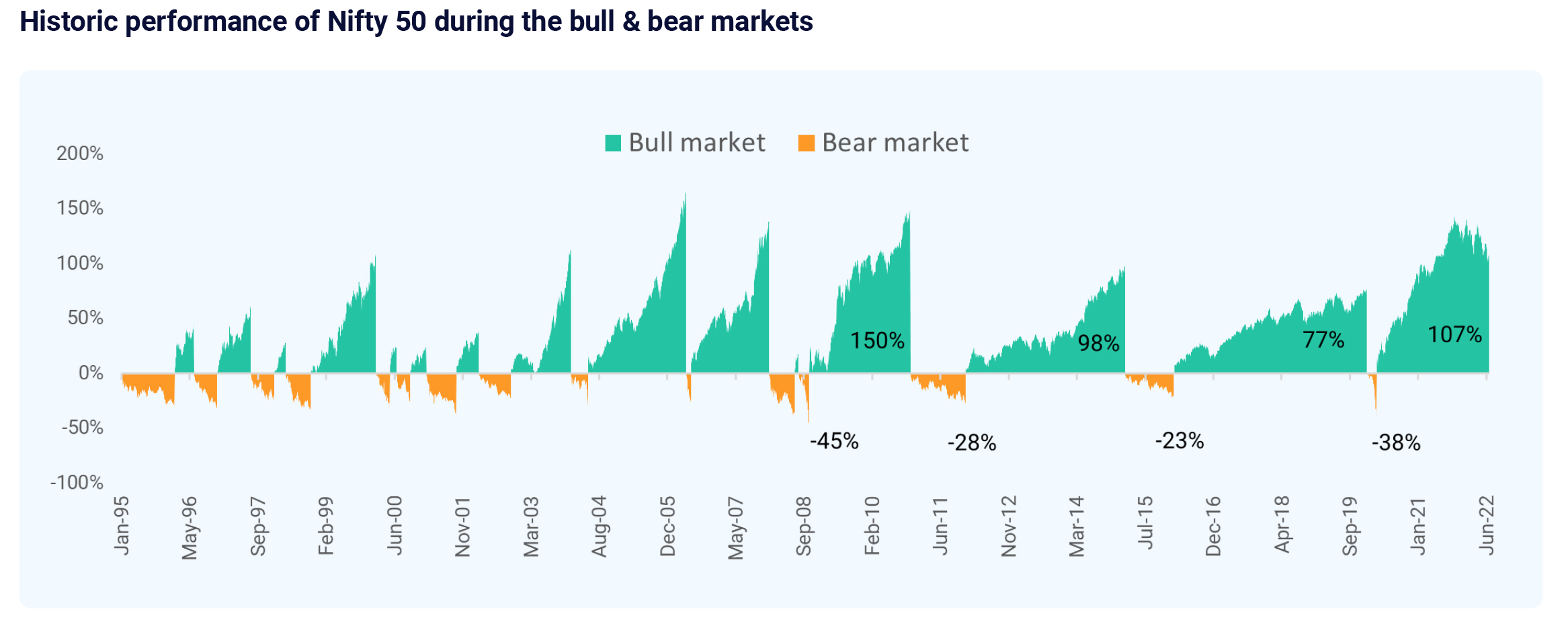

The value of many portfolios/stocks has dropped at a sobering rate which can cause anxiety to many investors. But it also creates an opportunity. Our historical analysis of how the stock market behaved in the previous market cycle can help investors understand the market better. We have seen that the market has always recovered—and the upturns have been stronger than the downturns. On average, a bull market in India lasts for ~16 months with an average profit of 81.3%, while a bear market lasts for a little more than six months with an average loss of -31.7%

Note: A bull market is measured after rising 20% from the bottom and continues to stay in the bull market phase until the market falls 20% from the peak

which would be characterized as a bear market. The current market phase continues to be in the bull market as the recent correction has not been to an

extent of 20%

Obviously, everyone wants to “buy low” and “sell high,” but most investors get caught up in the heat of the moment and do just the opposite. During periods

of extreme market volatility, staying calm and looking for good buying opportunities is essential. But remember, no one can time the bottom. Whenever the

markets have declined significantly in a short time, consider topping up your investments or, at the least, rebalance your portfolio to increase the equity

allocation. Dollar-cost averaging is a time-tested strategy that can help you ride the effects of market volatility.

Missing key days in the market can significantly impact your long-term portfolio returns. Investors who pull their money out of equities during volatile times

may miss some of the stock market’s biggest gains. That is because some of the market’s best days have come right after periods of steep declines.

Missing the best days in the market substantially reduced returns

|

Period: Jan 95 to Jun 22 |

||

|

|

Nifty 50 (CAGR) |

Growth of ₹10,000 |

|

All 6730 Days |

9.9% |

₹1,33,489 |

|

Missing 10 Best Days |

6.5% |

₹56,354 |

|

Missing 20 Best Days |

4.1% |

₹30,436 |

|

Missing 30 Best Days |

2.1% |

₹17,709 |