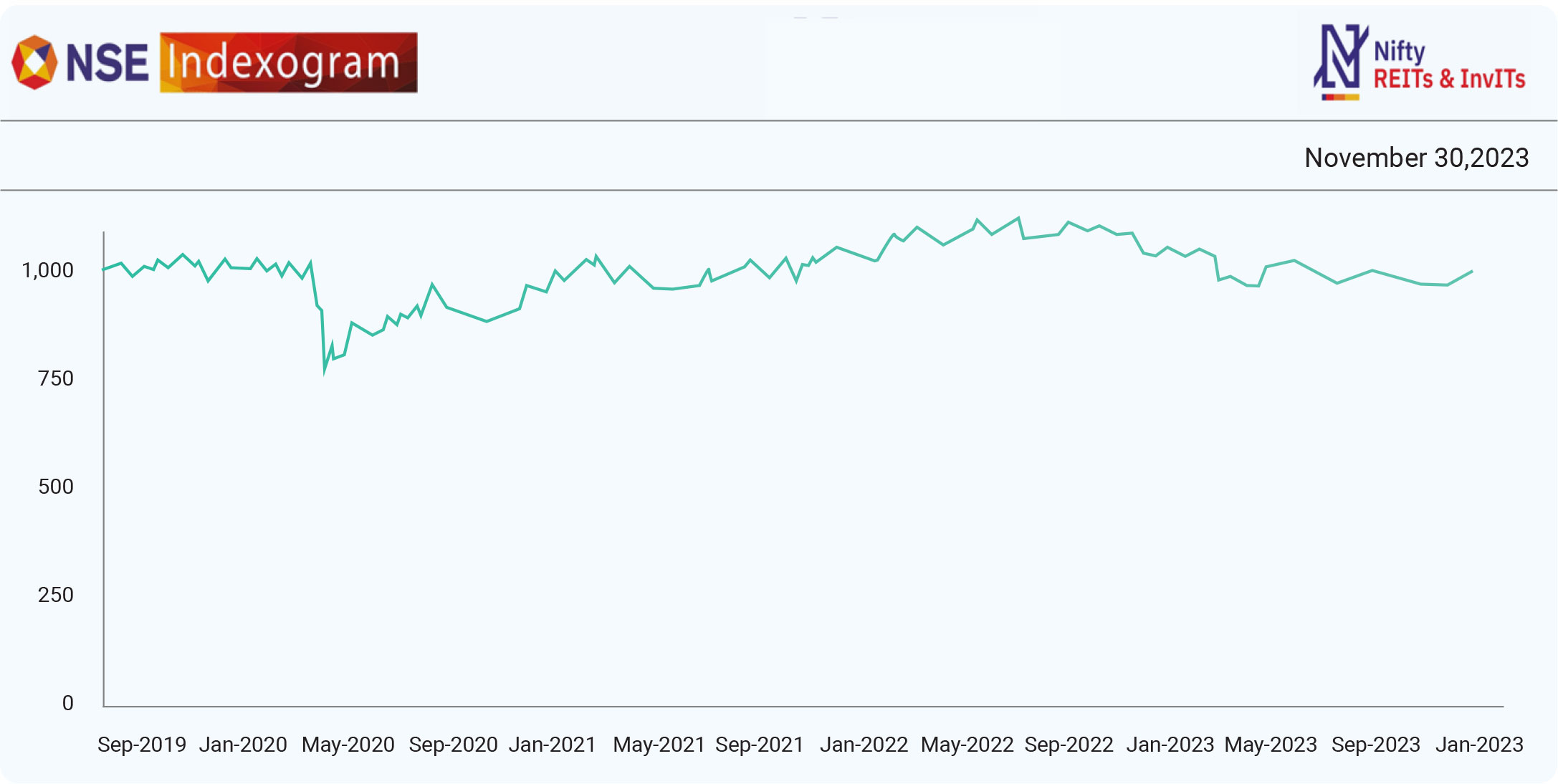

At the beginning of the current financial year, NSE Indices

Ltd, a subsidiary of the National Stock Exchange (NSE),

introduced India's first-ever Real Estate Investment

Trusts and Infrastructure Investment Trusts index — Nifty

REITs and InvITs Index. This index is designed to monitor

the performance of publicly listed and traded REITs and

InvITs on the NSE. It was a highly anticipated investment

tool for the real sector in India. The Indian government

launched InvITs and REITs to attract long-term yield

capital into the country and stimulate private

participation in infrastructure and real estate. Analysts

predict that the real estate sector in India will grow to a

market size of US$1 trillion by 2030. Despite near to

medium-term challenges from COVID-19, the long-term

drivers for real estate demand are robust and likely to

endure current adversities. The REIT/InvIT route has the

potential to address several investment challenges in the

infrastructure sector.

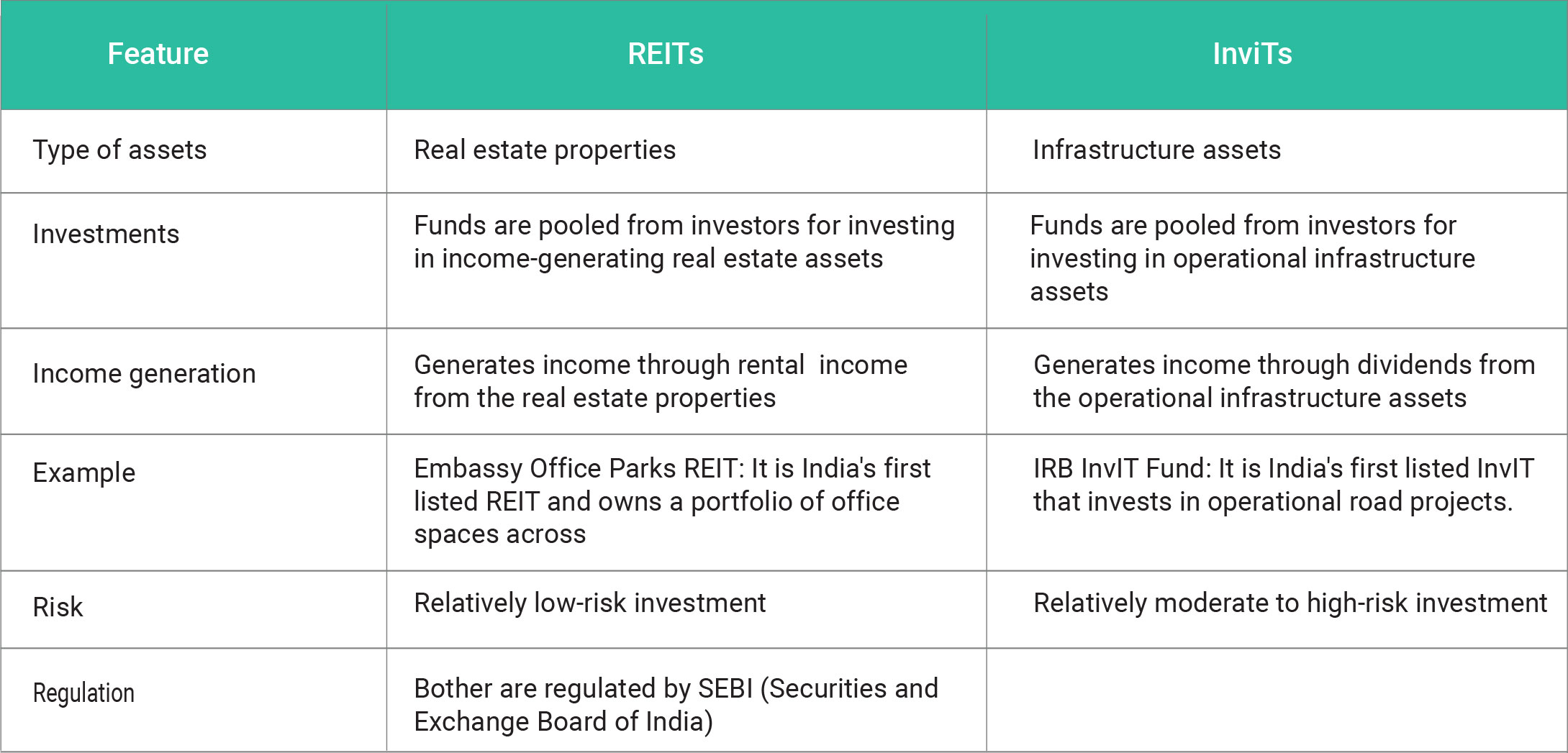

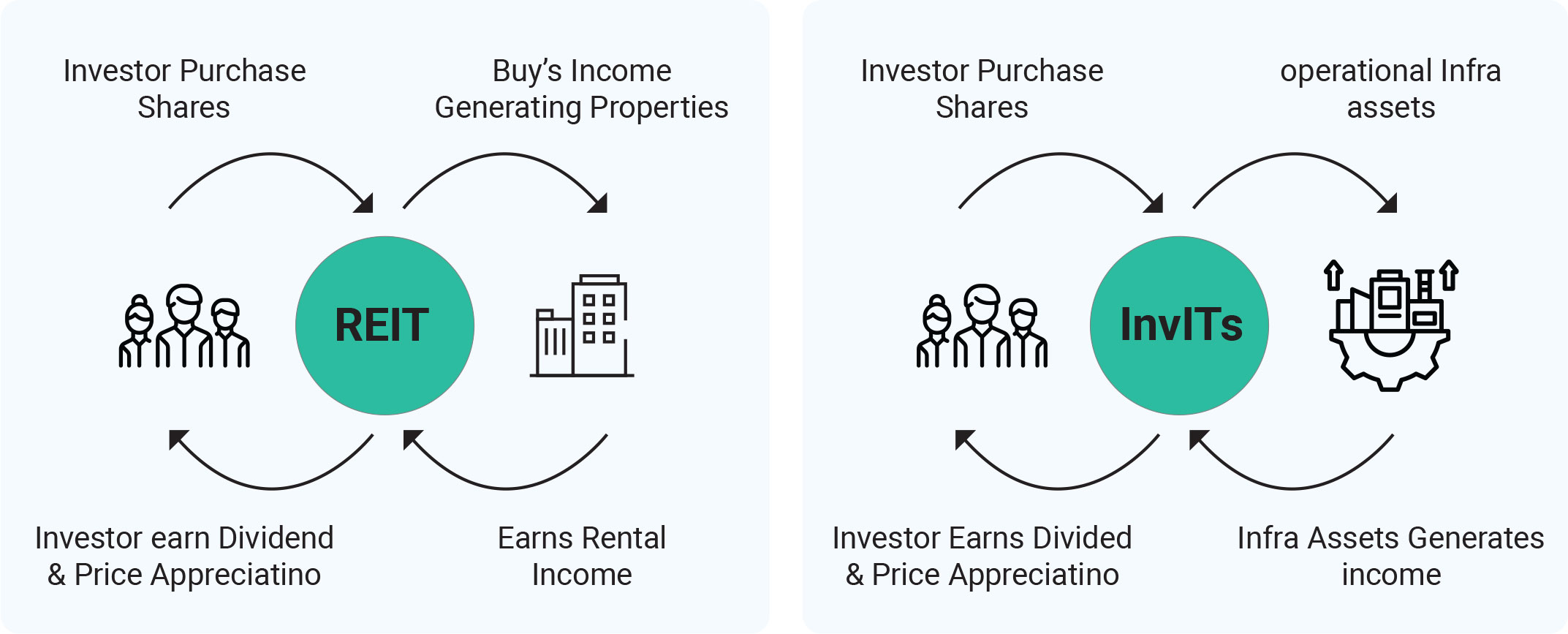

REITs and InvITs are conceptually akin to mutual funds,

where a sponsor raises capital and invests in

infrastructure or real estate projects. A Real Estate

Investment Trust (REIT) or an Infrastructure Investment

Trust (InvIT) is an investment vehicle that owns

revenue-generating real estate or infrastructure assets.

While REITs invest in real estate projects, InvITs focus on

infrastructure projects with a longer gestation period.

These trusts provide investors with exposure to

diversified, regular income-generating real estate and

infrastructure assets, making them strong financial

instruments for those seeking involvement in these

sectors.

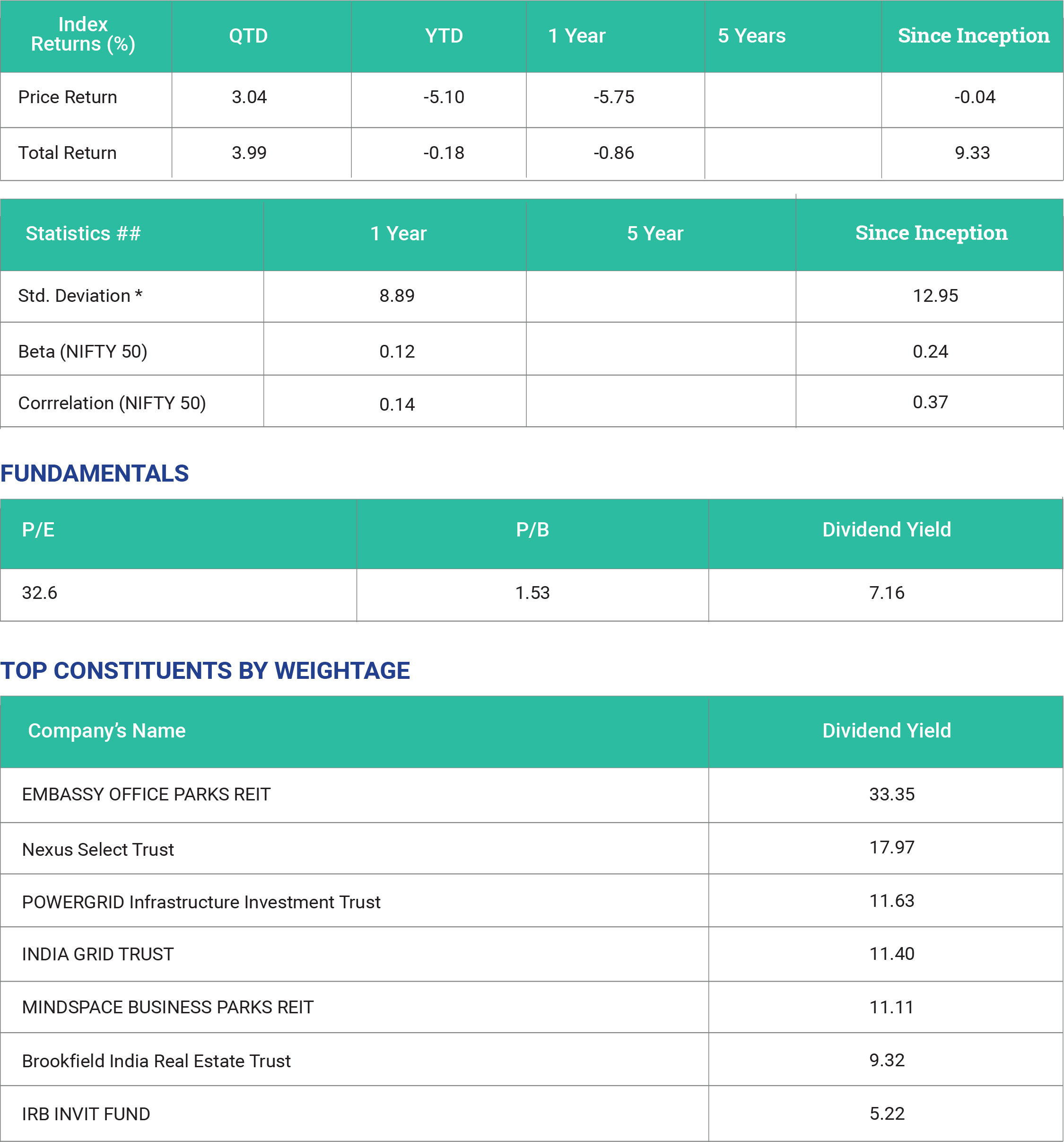

The Nifty REITs and InvITs index comprises securities

based on their free float market capitalization, subject to

a security cap of 33% each, with the aggregate weight of

the top three securities capped at 72%. The index has a

base value of 1,000 and undergoes quarterly reviews and

rebalancing. It serves as a benchmark for fund portfolios

and index variants.

For securities to be eligible for inclusion in the index, they

must meet certain criteria:

- REITs or InvITs must be domiciled in India and listed and traded on NSE; only publicly listed securities are eligible.

- Securities should have a market lot size of 1 unit for inclusion.

- A minimum listing history of 1 month as of the cutoff date is required.

- Securities should have a minimum trading frequency of 60% during the previous 3 months as of the cutoff date.

SEBI has consistently worked on strengthening the

regulatory framework for REITs and InvITs. To enhance

the efficiency of the public issue process, the time for

allotment and listing after the closure of REITs and InvITs

issues was reduced from 12 to 6 working days. For

privately placed InvITs, the timeline was shortened from

30 days to six working days, contributing to increased

market liquidity. According to SEBI, these innovative

mechanisms for financing real estate and infrastructure

can have a multiplier impact on India's economic growth.

SEBI has introduced rules granting special rights to REIT

unitholders, enabling them to nominate representatives

on the boards. Additionally, the concept of a

self-sponsored REIT was introduced. The market

continues to show interest in REITs and InvITs, with 3

new InvIT registrations and 1 new REIT registration

during 2022-23. The total registered entities now stand at

20 for InvITs and 5 for REITs. Listed REITs and InvITs

raised funds amounting to Rs 18,658 crore in the first

half of the current fiscal year, driven by robust demand

for infrastructure investment, attractive returns, and

supportive government policies. The data indicates that,

of this amount, Rs 12,753 crore was raised through

InvITs, and Rs 5,905 crore was collected via REITs. Tax

implications for REITs and InvITs are treated as

pass-through vehicles under income tax rules, with

income, in the form of dividends and interest from

underlying assets, being fully exempted. Distributions

made by investment trusts are directly taxed in the hands

of investors, depending on the nature of such

distributions (dividend, interest, or capital repayment).

It's worth noting that REITs and InvITs have different

income tax implications for sponsors, unitholders, and

the REIT or InvIT at various stages. With proactive

support from the government and regulatory authorities,

REITs and InvITs are being extensively promoted. High

levels of corporate governance from sponsors and

management are of utmost importance in establishing

these trusts. Maintaining consistent transparency in

financial reporting is crucial for building the foundation

for long-term success in this area. Given the sizeable

dependence of the Indian economy on infrastructure

development, these trusts have

become vital in addressing the country's infrastructure

needs. While REITs and InvITs are relatively new

concepts in the Indian market, they have been popular

choices in global markets due to their lucrative returns

and capital appreciation. This marks the advent of a new

era of growth driven by capital investments in REITs and

InvITs.