In the recent monetary policy, as expected the RBI hiked interest rates by

50 bps even though inflation has started to ease in India. An increase in

the rates was necessary to minimize the interest rate differential between

India and the US.

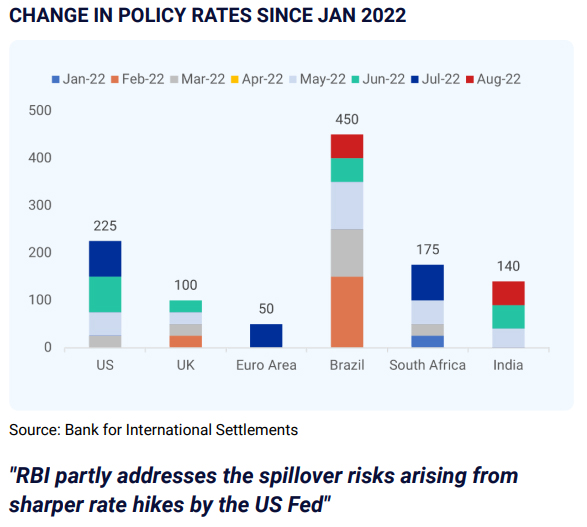

This year, the US Fed has hiked interest rates by a massive 225 bps, while

the RBI has just bumped up the rates by 90 bps (now 140 bps including

the recent hike). This increasing difference in the rates between the two

countries is one of the reasons foreign investors are pulling out money

from the Indian markets. This has also put pressure on our currency.

Given that the surplus liquidity in the banking system has tightened due to

the RBI’s intervention in the foreign exchange market to stabilize the rupee,

no measures were announced to suck out any liquidity.

Going forward, we expect inflation to hit below the 6% mark as the global

commodity prices are coming down. Also, we believe that the RBI shall

continue to follow the footsteps of the US Fed to avoid any major currency

volatility. Given the uncertainty with rate hikes and their magnitudes,

reduction in liquidity and substantial supply of government securities

coming up, bond yields are expected to remain under pressure. Also,

equity markets may fill jitters depending on any new upcoming data in

either the US or India.